The Chinese Communist authorities are currently cleaning up the financial territory of central and state-owned enterprises. It has been reported that Yang Chao, the former CEO of China Life Insurance, has lost contact. Yang Chao has close ties with Liu Leifei, the son of former member of the Politburo Standing Committee of the Chinese Communist Party, Liu Yunshan, and made substantial profits during Yang’s tenure.

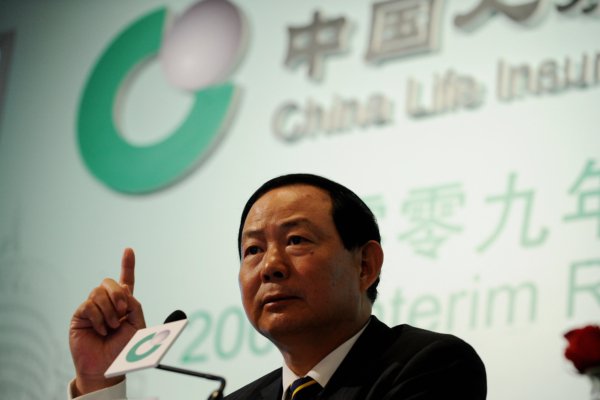

According to a report from the mainland financial media “Financial Frontline” on March 19, Yang Chao, the former Party Secretary and CEO of China Life Insurance (Group) Corporation (referred to as China Life), who has been retired for 14 years, is suspected to have lost contact. Reporters have tried to call his mobile phone multiple times, but it has remained unreachable.

At the age of 75, Yang Chao, a native of Shanghai, has worked in the Chinese insurance system for many years, including positions at China People’s Insurance Company. In May 2005, Yang Chao took the helm of China Life, serving as the Party Secretary and CEO of China Life Insurance (Group) Corporation, as well as the Chairman of China Life Insurance Company Limited and China Life Property Insurance Company Limited. Yang Chao retired in 2011.

Central and state-owned enterprises under the Chinese Communist Party have always been the turf of the princelings. Liu Leifei, the son of former member of the Politburo Standing Committee of the Chinese Communist Party Liu Yunshan, had close interactions with Yang Chao during his tenure at China Life. Liu Leifei currently serves as the CEO of CPE Source Peak.

In 2004, Liu Yunshan, who was then Minister of the Central Propaganda Department of the Chinese Communist Party, placed his 31-year-old son Liu Leifei in China Life Insurance Corporation, the largest institutional investor in the country. Liu Leifei’s public resume shows that he served as the Chief Investment Officer and General Manager of the Investment Management Department at China Life, responsible for asset-liability matching, strategic allocation, and investment management of nearly trillions of investment assets, and led a series of large-scale equity investments in projects such as Southern Grid, Guangfa Bank, Citic Securities, Visa, Minsheng Bank, China UnionPay, and Qinhuangdao Port, yielding “considerable returns.”

In June 2008, after the establishment of the Citic Industrial Fund, Liu Leifei left China Life to become the Chairman and CEO of the fund, and also served as a director of Citic Securities. However, even though he left, the cooperation between the two sides did not stop.

Previously, senior executives of China Life have had issues.

On November 15, 2018, Lin Dairen, the Party Secretary and CEO of China Life Insurance Corporation who had just retired, was severely warned within the Party for “violations related to the selection and appointment of personnel.”

In January 2022, Wang Bin, Chairman of China Life, fell from power, accused of accepting bribes totaling 325 million RMB and hiding foreign currency deposits in Hong Kong. In September 2023, he was sentenced to death with reprieve.