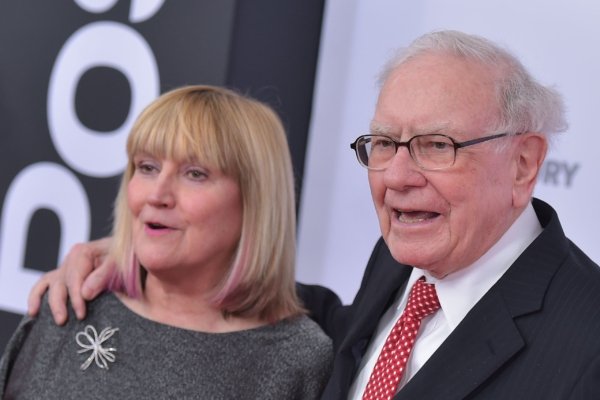

Warren Buffett, a super-billionaire and father of three children, advises all parents to have their children read their wills before signing them, regardless of the amount of wealth they leave behind. In a letter on Monday (November 25th), Buffett, whose personal wealth reaches $150 billion, emphasized the importance of ensuring that each child understands the decision-making logic and the responsibilities they will face after his passing.

The renowned investor stated, “Make sure that each child understands your decision-making logic and the responsibilities they will face after you pass away.” Despite his immense wealth, Buffett aims for his children to live comfortably without being burdened by wealth. “If anyone has questions or suggestions, carefully listen and adopt those reasonable ideas,” Buffett wrote in the letter. “You wouldn’t want your children to wonder ‘why?’ about your will decisions when you are unable to respond.”

At 94 years old, the legendary investor has not left substantial inheritances directly to his three children. He has pledged to gradually donate 99% of his wealth accumulated in Berkshire Hathaway company.

Douglas Boneparth, the founder and president of Bone Fide Wealth in New York City, agrees with Buffett’s advice, believing that parents should inform their children about their estate plans in advance. “These conversations are tough but meaningful, and if handled properly, they can strengthen relationships,” Boneparth said. As a registered financial planner and member of the CNBC advisory council, Boneparth emphasized the importance of ensuring that children have realistic expectations about the inheritance they will receive. He mentioned that children’s imaginations may lead to unrealistic expectations about what they believe they are entitled to.

According to Buffett’s recollection in the letter, he has witnessed over the years many families disintegrate due to confusing or anger-inducing instructions in wills provided to beneficiaries.

In his letter on Monday, Buffett again donated $11.4 billion worth of Berkshire Hathaway stock to four family foundations. Buffett has been running this conglomerate company based in Omaha, Nebraska since 1965.

“I see nothing wrong with defending my ideas. My father did the same for me,” Buffett wrote in the letter, stating his decision not to leave his vast wealth to his children because the distribution of substantial wealth could lead to negative consequences, such as hindering personal growth and complicating relationships.

Carolyn McClanahan, the founder of Life Planning Partners in Jacksonville, Florida, and a member of the CNBC advisory council, shared her perspective as a registered financial planner. She supported Buffett’s recommendation for children to understand the content of the will in advance as generally correct. However, she also pointed out that in certain unique situations, parents holding back information in the will may be wise.

“If your children are not mature enough, sharing this information could be harmful,” she said. In such cases, she might suggest clients write a letter to their children explaining their estate decisions, but the letter would only be revealed to the children after the parents’ passing.

“Every family situation is different,” McClanahan stated. “That’s why there should not be strict guidelines to follow.”