Numerous books on personal finance, financial planning, investments, debt management, and money matters flood the market nowadays. After reading these books, one common perspective emerges easily: personal finance is a straightforward subject, at least in theory.

To control wealth creation, one must grasp basic principles: “spend less than what you earn”; “own more than what you owe”; “repay high-interest debts quickly”; “prioritize your own life”. These principles are well-known and still very effective.

However, despite the simplicity of these principles, many people, whether Canadians or Americans, face financial challenges. Why do we struggle to control our spending behavior and save money? Worse, why do we incessantly overspend and indulge in extravagant desires?

The root cause lies in various psychological, behavioral, and societal factors affecting our spending habits. This article will briefly introduce a method to help individuals understand these factors correctly and apply them wisely to manage their spending behavior.

While economic conditions, government decisions, or inflation indeed impact our financial situation, going beyond these objective factors is essential to control spending behavior, balance budgets, and eliminate debts without the associated mental anguish and burdens.

Breaking free from conventional money mindsets and consciously evaluating our spending choices from a priority perspective rather than impulsivity is crucial. It involves bringing spending into a conscious state and examining it with full awareness and self-discipline.

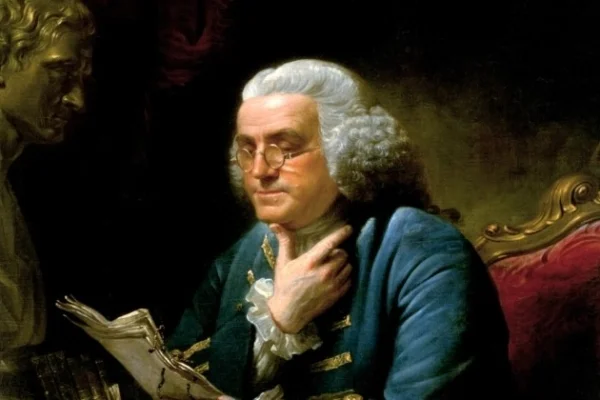

In this article, a method inspired by American founding father Benjamin Franklin’s approach will be elaborated. Franklin, a politician, diplomat, scientist, and entrepreneur, proposed a simplistic strategy in his works, including categorizing expenses, purchasing, and saving needs, prioritizing them accordingly.

Franklin advised limiting expenses to essentials and perhaps a few conveniences, saving the rest. By doing so, one can save substantial amounts of money and avoid falling into the traps of pride and vanity-driven debts for luxuries.

Applying Franklin’s principles in real life, such as setting aside part of income for retirement savings or emergency funds, before allocating funds to other categories like house maintenance or luxury items, aligns with prioritizing one’s own life.

Establishing an emergency fund or using money to repay credit card debts provides peace of mind and is more gratifying than spending on unnecessary items. If one’s income is insufficient to allocate funds reasonably to retirement accounts or build an emergency fund, it likely indicates overspending beyond one’s means, necessitating a reevaluation of lifestyle choices.

Conscious awareness of one’s financial decisions is pivotal to controlling those decisions. Managing money mindfully can prevent falling into the trap of emotional spending and lead to a healthier financial standing.

By utilizing a spending window to address current and future expenses simultaneously, individuals gain a better grip on their financial present and future, enabling them to exercise better control over their finances.

In conclusion, consciously focusing on spending behavior may be one of the most critical financial decisions in one’s life. It not only enhances financial reserves but also fosters personal growth and character development through cultivating discipline and self-restraint in spending habits.

Implementing a practical financial method only requires a pen and paper. Listing expenses, planned purchases, and saving requirements on paper alongside categorizing and prioritizing them can help individuals exercise conscious and prudent decision-making.

Let’s learn and apply these principles together for a more secure financial future.